Irs Tax Form 1040 Es Download

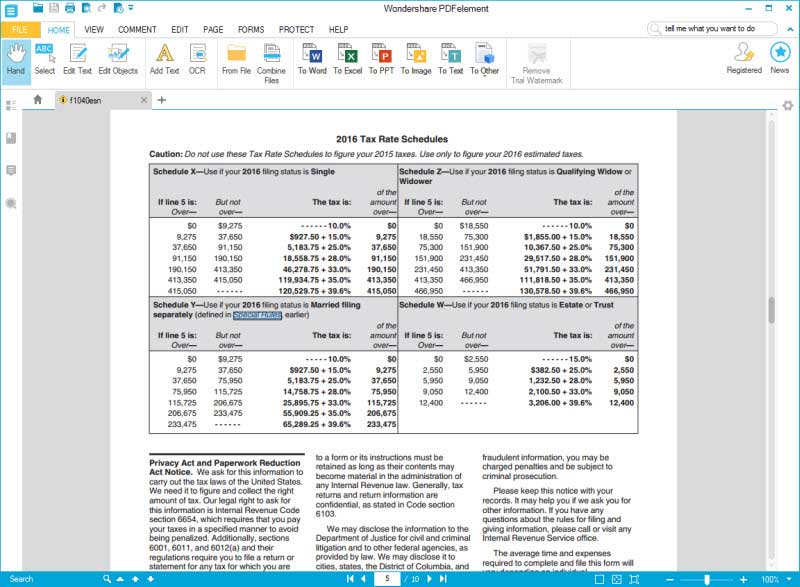

- 2015 Form 1040-ES Estimated Tax for Individual free download and preview, download free printable template samples in PDF, Word and Excel formats.

- The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

SignNow's web-based service is specifically developed to simplify the arrangement of workflow and improve the whole process of qualified document management. Use this step-by-step guide to complete the Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals quickly and with ideal precision.

The way to complete the Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals on the internet:

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

- To get started on the blank, utilize the Fill & Sign Online button or tick the preview image of the document.

- The advanced tools of the editor will lead you through the editable PDF template.

- Enter your official identification and contact details.

- Apply a check mark to indicate the choice wherever required.

- Double check all the fillable fields to ensure complete precision.

- Utilize the Sign Tool to create and add your electronic signature to certify the Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals.

- Press Done after you finish the document.

- Now it is possible to print, download, or share the document.

- Refer to the Support section or get in touch with our Support staff in the event you've got any questions.

By making use of SignNow's complete platform, you're able to complete any required edits to Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals, make your personalized digital signature in a couple of fast steps, and streamline your workflow without the need of leaving your browser.

Video instructions and help with filling out and completing Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals

Instructions and Help about Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals

laws calm legal forms guide form 1040 - AES is a United States Internal Revenue Service tax form used as an estimated tax payment voucher the form includes four separate vouchers Alduin quarterly filings throughout the year the form 1040 - es is used for self-employed workers who do not have enough income tax withheld the form 1040 - es can be obtained through the IRS a--'s website or by obtaining the documents through a local tax office the tax form is to be filed by the taxpayer in quarterly installments for separate tax vouchers are included in the form with each needing to be filed by the specified due date before filling out a quarterly voucher you should use the tax worksheet provided with the form go line by line through the worksheet and enter your best estimation of the numbers asked for example line 1 requires your expected gross income for the entire 2011 tax year follow the instructions of each line double checking that your numbers are accurate once completed you should ha

FAQ

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Is it more beneficial to file Form 709 Gift Tax than the 1040 (A -X -EZ) for 2019?

Form 709 is for the giver of gifts exceeding $15,000 per person per year (double that for spouses giving jointly, double again if the recipients are married and the gift is to both). Instructions for Form 709 (2018)Form 1040 is for your own income tax - and gifts are not taxable income to the recipient.

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before reaching AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Why is the individual mandate on the current tax form (2018 1040 individual tax return to be filed in 2019 page one under spouse's SSN) when it was supposed to be done away with?

The penalty for not having health insurance was set to 0 for 2019 and later years. You must still pay a penalty for not having health insurance during any months of 2018. Since you are filing taxes for 2018 tax year now, you will have to calculate (and pay, if applicable) the penalty for 2018 on there.

A Self-Employed S-Corporation owner who pays himself a quarterly salary. Who is responsible for payment of the quarterly social security and Medicare tax, the S-Corporation on Form 941 or the business owner on Form 1040-ES?

First of all, he can't be a 'self-employed S-Corporation owner.' If he owns and performs services for an S-corp, he is not self-employed -- he is an employee of the S-corp. His salary is subject to withholding (income tax and FICA), and the S-corp is liable for the employer share of FICA. So the S-corp would pay the social security and Medicare tax on the owner's salary on its quarterly 941's.(Anything that the owner receives from the S-corp other than as salary is not wages subject to FICA, so there is not withholding and no tax to pay with the 941. It is income to the owner, though,)

An S-Corp owner pays himself a salary on a quarterly basis. Does the business he owns need to file a Form 941 and he the individual file a 1040-ES, each needing to be filed quarterly?

An S-Corp “owner” doesn’t have to pay themselves at all if they don’t actively work in the business. If they actively work in the business, they need to pay themselves a reasonable salary (which is quite a subjective concept.) Whether the salary is paid weekly, bi-weekly, semi-monthly, monthly, or quarterly is, for the most part, irrelevant. Theoretically you might even be able to justify an annual payment, but that’s not really the topic here. (I do believe you’d have some explaining to do if the “owner” is actively working, and not being paid on the same timetable as the employees, but, again, that’s a different topic.)And, yes, the business will have to file a 941 form, pay the company’s share of taxes, AND forward the employee’s share of taxes collected, too.When the business pays the “owner” their salary, the business should be withholding taxes just as the business would when paying any other manager or executive receiving a salary.So if this is the only money that the “owner” is being paid, they probably don’t need to file estimated taxes because a sufficient amount of taxes are being withheld already. If the “owner” is also paying themselves unearned income as a dividend, then they may need to file estimated taxes on the amount of this equity distribution, from which taxes are not withheld. But I would be very, very careful about taking an equity draw in addition to the salary you need to take. This is territory that you don’t want to get into without the advice of a competent CPA.Now, if the “owner” is not actively involved in operating the business, they may not need to be paid a salary. That is another topic to discuss with your CPA.Note that I’ve put “owner” in quotes because technically, corporations are owned by stockholders, just like LLC’s don’t have “owners”, but rather members, and partnerships have partners. The different terms tell us that the roles are different, as are the responsibilities. Calling any of them an “owner” implies a certain level of participation that may or may not match their actual role in the company.

In the USA, how do full-time stock traders estimate their taxes given unpredictability of income every year? I assume 1040-ES is the only way to withhold taxes.

Full time stock traders, or Day Traders, are self employed and are required to determine their income on a continual basis. The first quarter’s estimated tax payment is due April 15th and is based on income for the first three months of the year. The second payment, due June 15th, is based on the income from January 1st through May 31st. The payment due September 15th is based on the net income for the first 8 months of the year. The last payment, due January 15th of the next year is based on net income for the year. The sum of your estimated payments should be at least 90% of the final tax due on your return in order to avoid penalties.Remember that the income for each period should be reduced by any expenses or deductions incurred during the period. Including the deduction for a portion of the self-employment social security tax.The estimated income tax plus the expected self-employment tax are both due together on the same dates.

If an undocumented resident wants to pay taxes and she is paid in cash by her employer, how can she file taxes when she applies for an ITIN? Does she use a Schedule C Form 1040 or a Form 4852?

Schedule C is used if the person is self-employed. Form 4852 is used for employment. There is a difference.

Related content Get And Sign 2019 Form 1040-ES. Form 1040-ES, Estimated Tax For Individuals

to download this year's spreadsheet.

the 2019 Income Tax Estimator spreadsheet.

- o Implementation of changes from

2017 Tax Cut and Jobs Act (TCJA)

o Significant Revision of Form 1040

and implementation of new Schedules 1 - 6

o Added new

Qualified Business Income Deduction (QBID)

Simplified Worksheet

for filers with taxable income <$157,500

(<$315,000 if MFJ)

o Created unofficial worksheet for QBID

for filers with higher taxable incomes

o Added Medical & Dental Expense

Worksheet (Unofficial) to Schedule A - o Added Schedule R, Credit for Elderly or the Disabled

o Added auto-select for Schedule SE

(Short Schedule vs. Long Schedule)

o Added Schedule 8812, Additional Child Tax Credit

o Added '80% Waiver' worksheet to Form 2210

Download Earlier Versions

To download earlier versions, click on one of the following links.

In 2007 through 2010, I was forced to split the spreadsheet. This was due to the fact that earlier versions of Microsoft Excel limited the number of cell format changes. For example, Schedules D-1, Continuation Sheet for Schedule D, and E, Supplemental Income and Loss, were split out because they contain a lot of format changes and they are mostly 'stand alone' schedules.

From 2011 through 2014, a newer version of Excel was used to prepare the spreadsheet; however, an Excel 97-2003 (Lite) version was available for users who do not have Excel 2010 (or later).

For 2015 (and later), the Lite version is discontinued.

Tax Year -> | 2017 | 2016 |

| File - | 17_1040.xlsx | 16_1040.xlsx |

Tax Year -> | 2015 | 2014 | 2013 | 2012 | 2011 |

| File -> | 13_1040.xlsx | 12_1040.xlsx |

Tax Year -> | 2010 | 2009 | 2008 | 2007 | 2006 |

| File -> | 10_Schedules_D1_&_E.xls |

Irs Tax Form 1040 For 2018

Tax Year -> | 2005 | 2004 | 2003 | 2002 | 2001 |

| File -> | 05_1040.xls | 04_1040.xls | 03_1040.xls | 02_1040.xls | 01_1040.xls |

Tax Year -> | 2000 | 1999 | 1998 | 1997 | 1996 |

| File -> | 00_1040.xls | 99_1040.xls | 98_1040.xls | 97_1040.xls | 96_1040.xls |

2018 Irs Tax Forms 1040

Please provide feedback!!

Help me and your fellow taxpayers out by letting us know what you think.

Thank you!!!

TaxCalculator

This spreadsheet is free.

However, if you would like to show your appreciation,

you may make a contribution by clicking this link or the PayPal logo (below):

paypal.me/incometaxspreadsheet

IncomeTaxSpreadsheet@gmail.com

OR

OR

Address:

Glenn Reeves

(Tax Calculator)

1 Burlingwood Ct.

Burlington, KS 66839-2418

Note 1: I will report all donations as income.

Note 2: I will contribute 10% of any and all donations to my local church!

Thanks!!!

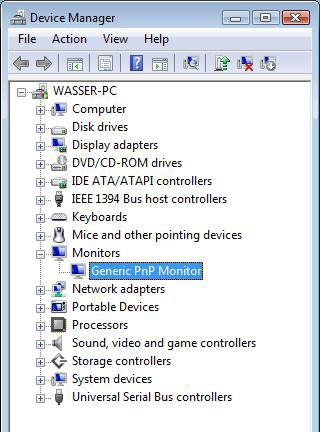

Just remember, applying an untrustworthy driver won't eliminate the negative issues on your pc, and might possibly make issues even worse. Getting your personal machine shutdown unexpectantly is one of the most dreaded result of bad drivers, like generic wireless card driver, and should be avoided at all costs, if you want to maintain all your info. Use the links on this page to download the latest version of Generic IEEE802.11g Wireless LAN drivers. All drivers available for download have been scanned by antivirus program. Generic network drivers - drivers for windows xp manual installation guide zip generic network drivers - drivers for windows xp driver-category list Faulty drivers might possibly damage other types of drivers, so in case you seek to download generic network drivers by hand be cautioned to search for additional damaged drivers in the process. 21 rows Driver version varies depending on the wireless adapter installed. Drivers: Windows 10, 32.

Just remember, applying an untrustworthy driver won't eliminate the negative issues on your pc, and might possibly make issues even worse. Getting your personal machine shutdown unexpectantly is one of the most dreaded result of bad drivers, like generic wireless card driver, and should be avoided at all costs, if you want to maintain all your info. Use the links on this page to download the latest version of Generic IEEE802.11g Wireless LAN drivers. All drivers available for download have been scanned by antivirus program. Generic network drivers - drivers for windows xp manual installation guide zip generic network drivers - drivers for windows xp driver-category list Faulty drivers might possibly damage other types of drivers, so in case you seek to download generic network drivers by hand be cautioned to search for additional damaged drivers in the process. 21 rows Driver version varies depending on the wireless adapter installed. Drivers: Windows 10, 32.